Lush’s Company Tax Policy

A letter from Hilary…

A general dislike of seeing money vanish from one’s wage packet, coupled with dissatisfaction with the quality of services offered by our local authorities and central governments, means that ‘tax’ has become a dirty word and we have all become used to hearing it talked about only in negative ways.

But Tax is bad, isn’t it?

This idea that tax is the common enemy of all people has led some companies to think that it is somehow acceptable to manipulate their business structures and accounting practices to avoid paying their contribution. But this attitude is not just self-serving, it is also short sighted, because those taxes are what will keep the infrastructure of our society in place and deliver healthy customers to our doors on well maintained, clean, lit streets.

At their hearts, the public know that education, health services, welfare and social care structures are essential and need to be paid for from the collective purse – and they resent any company who evades these tax responsibilities whilst they, as individual members of the public, have no way to opt out of the tax deductions from their own wage packet.

At Lush, we believe that we should pay a fair tax in each of the countries in which we operate. We will take advantage of legitimate business tax structures and benefits available in each country – but we will never search for loopholes or devise schemes that stretch the rules beyond their obvious intended purpose.

Lush wants our customers to have a safe living environment, to have access to good education and efficient healthcare services – and we know that taxes are needed for this. As a company, we feel we should contribute back into the societies from which we trade by being a good employer, by trading fairly with our suppliers and by paying our taxes into the collective purse.

Whilst we acknowledge our obligation to pay tax, here at Lush we also recognise our right to speak out about how those taxes are spent by governments. We will continue to publicly campaign on a variety of issues and press for a kinder, fairer society, so that all of us can pay tax into a system we can feel proud of, and which supports everyone in society equally.

Ethics Director, Hilary Jones, December 13th 2013.

LUSH ETHICAL TAX POLICY, June 2023

At Lush we are proud of our products and proud of our ethics. In addition to our existing “We Believe” (Lush Values) statement, we have developed our Ethical Tax Policy to ensure that our staff, our customers and our suppliers are clear about our company structure and our commitment to paying our taxes.

LUSH VALUES STATEMENT:

- We believe in making effective products from fresh, organic* fruit and vegetables, the finest essential oils and safe synthetics.

- We believe in buying ingredients only from companies that do not commission tests on animals and in testing our products on humans.

- We invent our own products and fragrances, we make them fresh by hand using little or no preservative or packaging, using only vegetarian ingredients, and tell you when they were made.

- We believe in happy people making happy soap, putting our faces on our products, and making our mums proud.

- We believe in long candlelit baths, sharing showers, massage, filling the world with perfume and in the right to make mistakes, lose everything and start again.

- We believe our products are good value, that we should make a profit and that the customer is always right.

- We believe that all people should enjoy freedom of movement across the world.

- * We also believe words like ‘Fresh’ and ‘Organic’ have an honest meaning beyond marketing.”

LUSH TAX STATEMENT:

- We believe not only in paying tax in accordance with all relevant laws and regulations in the territories in which we operate but also in not using complicated tax loopholes to take advantage of legal but essentially questionable tax schemes.

- We believe that we should pay the right amount of tax in each country and not overpay taxes in any country.

- We believe that we should pay our taxes on time and agree payment plans with local tax authorities in advance where this may not be possible. For example where financial implications may arise because of natural disasters, unforeseen emergencies, or other occurrences outside of our control.

- We believe in minimising the risk that transactions or relationships may have unforeseen adverse tax consequences by using our professional care and judgment to assess situations and projects to make decisions.

- We believe in correcting inadvertent errors we identify promptly with full disclosure to the tax authorities.

- We believe we should have a clear Transfer Pricing Policy to ensure that the way we charge between our Inventing, Manufacturing and Retail companies is transparent, arm’s length, benchmarked and properly documented, and that it complies with local laws. We aim to refresh our Policy regularly.

- We believe we should engage with tax authorities in an open and honest way and discuss any specific uncertainties or issues on time wherever possible.

- We believe in operating our business in the simplest possible way with decisions being driven to serve our customers, to encompass our values, to look after our staff and to generate a profit and not by tax planning for tax avoidance purposes, or taking advantage of the secrecies afforded by tax havens.

- We believe our group tax rate should be determined by the sum of the parts and not something that is targeted.

- We believe local companies should claim the proper statutory reliefs in the countries in which they operate and should never use marketed or abusive tax avoidance schemes.

- We believe in giving guidance to our Finance Teams to help them make the right tax decisions (see Criteria below).

- We believe the availability of a tax deduction should not be the determining factor when considering charitable giving.

The overall tax policy focuses on 2 key areas; transparent disclosure and clear responsibility:

1. Transparent Disclosure

Openness, honesty, and transparency are paramount in all dealings with tax authorities and we support initiatives to improve transparency on tax matters, such as Country-by-country reporting.

Since 2014 we have chosen to include a country-by-country breakdown of the taxes incurred in the countries in which we operate, and some key financial information alongside this, within our financial statements, to improve our transparency and enable the readers of our UK consolidated annual accounts to understand the results and effective tax rates – and perhaps encourage other businesses to follow suit.

We are extremely proud to have been awarded the Fair Tax Mark in response to our open and transparent approach to our tax affairs. Lush was the first High Street multinational company to be awarded the Mark which is an accreditation scheme awarded to companies making a genuine effort to be open and transparent about their tax affairs. As stated by Richard Murphy, co-founder of the Fair Tax Mark, at the time of the Mark being awarded in February 2015 “this is genuinely ground-breaking for a multinational in the retail sector”.

2. Clear Responsibility

Group Finance Function

Responsibility for agreeing, issuing, and communicating our Lush Tax Policy sits with the Group Finance Function on behalf of Mark Constantine and the Board, and in conjunction with Hilary Jones, Lush’s Ethics Director.

A copy of the Lush Tax Policy is available to all staff and is published on the WeAre.Lush.com website, along with our Ethics, Green and other policies.

Group Finance are responsible for establishing arm’s length transfer pricing policies which will be documented and implemented with the local FDs. Our transfer pricing policy seeks to ensure profits are taxed in the company and country in which the value is created.

Local Country Finance Directors and Finance Teams

Responsibility for all tax reporting and adherence to the Lush Ethical Tax Policy sits with the local Finance Directors (FD’s) in each Country.

FD’s and controllers are responsible for understanding the local tax legislation and procedures for the countries in which they operate and for keeping up to date with and complying with all applicable laws, rules, and disclosure requirements.

Where the tax treatment or reporting requirements of specific items are unclear, professional advice should be sought by the FD or finance team, who are encouraged to seek external tax advisor advice, where required.

They are also responsible for filing all tax returns on time and as accurately as possible. The use of external advisors for tax return completion is also advised where local inhouse resource is not available.

The FDs should develop good working relationships with tax authorities and respond to their requests in a friendly, timely and professional manner.

FDs should notify the Group Finance function of any specific tax issues arising in their country as soon as possible after being initially identified to provide input and be aware of the implications of such issues.

With the Lush Group being exposed to a significant amount of change and growth in recent years, the group finance function recognises the increased tax risk and continues to implement and maintain adequate frameworks and controls aimed at mitigating these risks.

The FDs are responsible for all internal tax reporting; including maintaining and monitoring internal policies and procedures to manage tax risk and ensure:

- All tax charges are calculated in accordance with group accounting policy.

- Tax payments are forecast accurately for cash flow reporting purposes.

- Tax reporting packs, prepared for statutory accounts purposes, are provided on a timely, complete, and accurate basis.

- Any ad hoc tax reporting requests are responded to in a timely manner.

CRITERIA FOR MEASURING TAX DECISIONS:

We recognise that tax is a complex subject and that sometimes help will be needed to evaluate our business decisions in relation to tax. As a guide, we consider the following points when making these decisions:

- Is what we are doing in pursuit of our commercial goals and in line with our values?

- Is it simple?

- Is the tax treatment for it technically correct?

- What is the impact on our customers?

- What is the impact on our employees?

- What is the impact on our shareholders?

- What is the impact on the societies in which we trade?

- How much does it cost?

RELATIONSHIP WITH HMRC

As a large business, the UK Group has its own Customer Compliance Manager at HMRC who we have continued to have regular, open, and honest dialogue with throughout the year. In addition to regular collaborative communication, the UK Group is subject to HMRC’s formal Business Risk Review (“BRR”) process. The BRR allows Lush to discuss our current, future, and past tax risks in an open and collaborative manner and allows significant items and tax specific matters to be raised, and their tax implications addressed.

We are only human and where inadvertent errors are identified, we ensure these are disclosed promptly to HMRC to agree any necessary corrections.

When submitting our UK corporation tax returns and computations we ensure that appropriate reports are submitted to HMRC, where required, to support any claims.

OVERVIEW OF GROUP COMPANY STRUCTURE:

Whilst our tax policy is driven by simplicity and transparency it is important to understand that we are in the business of manufacturing and retailing beautiful handmade cosmetics as well as inventing new products; some of which are protected by patents and trademarks. We are proud to have invented the bath bomb and our inventors work hard to deliver innovative and effective solid products to minimise the use of packaging (e.g. solid shampoo bars and shower gel).

Lush is therefore more than just one company and we control the various parts of the organisation by operating the different business disciplines as separate companies.

Lush Cosmetics Limited is the holding company for our businesses that develop, manufacture and retail fresh handmade cosmetics.

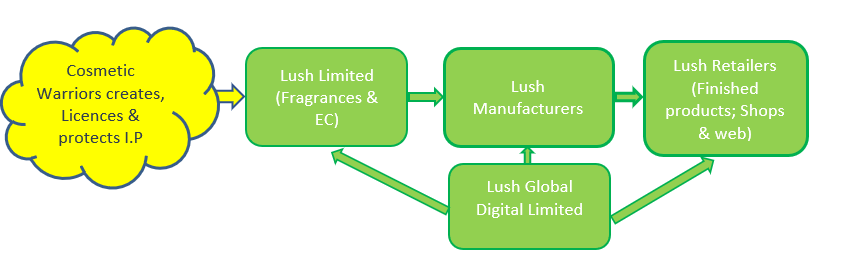

A company called Cosmetic Warriors sits outside the group for accounting and tax purposes but for transfer pricing purposes it is a connected party and transactions with Lush companies are at arm’s length. This is a UK trading company that creates, holds, and protects the Intellectual Property (IP) rights, trademarks, and patents for our beautiful products. Cosmetic Warriors charges a licence fee for the use of the IP. As long as our inventors continue to live and invent our products in the UK, the company holding their patents and trademarks will reside and be taxed here too.

To help to understand the Group Company structure the following is a summary:

Lush Limited produces all the Lush fragrances and Essential Components (ECs) which they sell on to those countries who have manufacturing facilities. This avoids the need to transport bulk finished product around the world thereby helping to reduce the environmental impact of our operation. All Group manufacturing countries pay the same price for the fragrances and ECs they buy. In addition to producing Lush fragrances and EC’s, Lush Ltd supports all group and partner markets in respect of; maximising the potential of the brand and consolidating brand strategies, ensuring adequate training is offered to all areas of the business, managing events on both an international and national level, and maintaining responsibility for legal and financial obligations centrally.

Lush Global Digital Limited oversees and implements the Group’s digital strategy. The principal activity is the development and provision of digital products and services to the Lush Group of companies, as well as the creation of new digital sales channels for external customers.

Guidance for Employees

If any member of staff suspects any individual of not adhering to our Ethical Tax Policy, they should report this through our Whistleblowing line, in total confidence, at [email protected].

For more details on the Tax Policy or to discuss specific issues within it, please contact Kim Coles ([email protected]) who prepared the first version of this policy on behalf of The Board in December 2013.

Kim Coles; December 2013

Last updated by Karina Dominey; June 2023

Lush Cosmetics Limited and its subsidiaries consider this document as complying with the requirements under Finance Act 2016, Schedule 19, Paragraph 16(2) for the year ended 30 June 2022.

Further reading →

12:11